Build Real Investment Skills That Actually Work

Most folks jump into investing without a plan. They chase hot tips and end up confused. Our program starts from scratch and builds your knowledge step by step through hands-on practice with real market scenarios.

Start Your Journey

Three Phases That Build On Each Other

We don't rush through theory. Each phase gives you time to practice before moving forward. You'll work through actual investment scenarios and learn from mistakes in a safe environment.

Foundation Building

Start with how markets actually function. No jargon overload. Just clear explanations of what you need to know before making any decisions.

- Market structure and participants

- Risk assessment fundamentals

- Financial statement basics

- Asset class characteristics

Strategy Development

Learn different approaches to portfolio construction. Test them with historical data. See what worked, what didn't, and why timing matters more than people think.

- Portfolio allocation methods

- Diversification techniques

- Market cycle analysis

- Rebalancing strategies

Advanced Application

Put everything together with complex case studies. Handle market volatility scenarios. Build plans that adapt to changing conditions without panic selling.

- Advanced portfolio management

- Tax-efficient strategies

- Behavioral finance principles

- Long-term planning frameworks

What You'll Actually Learn Each Week

Week 1-4: Market Fundamentals

Forget dry textbook stuff. You'll analyze real company financials, compare investment vehicles side by side, and understand why some assets behave differently during economic shifts.

Week 5-8: Portfolio Construction

Build mock portfolios with different objectives. See how a retirement portfolio differs from a growth-focused one. Learn why diversification isn't just about buying different stocks.

Week 9-12: Risk Management

This is where most people mess up. You'll practice identifying risks before they bite you, and develop strategies to protect your portfolio without being overly cautious.

Week 13-16: Market Psychology

Markets move on emotions as much as data. Study historical panics and bubbles. Learn to recognize when you're making emotional decisions instead of rational ones.

Week 17-20: Advanced Strategies

Tax optimization, estate planning considerations, and how to adjust your approach as life circumstances change. The stuff that separates okay results from great ones.

Real Scenarios You'll Work Through

Theory only gets you so far. These case studies are based on actual market situations from 2019-2024. You'll see what worked, what failed spectacularly, and why.

The 2020 Market Drop

When markets fell 35% in March 2020, most people panicked. This case walks you through two investors with similar portfolios who made very different decisions. You'll analyze both approaches and their five-year outcomes.

Key Takeaways

Emergency planning isn't optional. Rebalancing during volatility can feel wrong but often proves right. Having cash reserves changes everything about how you handle downturns.

Growth vs Value Timing

From 2017 to 2024, growth stocks crushed value investing. Then suddenly in late 2022, everything flipped. Study portfolios that stuck to their strategy versus those that chased performance.

Key Takeaways

Style drift happens slowly until it doesn't. Diversification feels stupid right before it saves you. Understanding your own investment timeline matters more than market predictions.

Rising Interest Rate Environment

Bond investors got hammered in 2022-2023 when rates jumped faster than anyone expected. This case examines different bond ladder strategies and how duration risk actually plays out.

Key Takeaways

Fixed income isn't risk-free. Duration matters way more than most people realize. Having a strategy for reinvesting in rising rate environments can turn pain into opportunity.

Sector Concentration Risk

Tech stocks dominated returns for years. Investors who concentrated portfolios there saw amazing gains until they didn't. Compare outcomes of focused versus diversified approaches through full market cycles.

Key Takeaways

Past performance really doesn't guarantee future results. Concentration builds wealth until it destroys it. The best risk management often feels like it's costing you money.

Learn From People Who've Made The Mistakes

Our instructors aren't just academics. They've managed real portfolios through multiple market cycles and learned lessons the hard way. They'll share both their wins and their screw-ups.

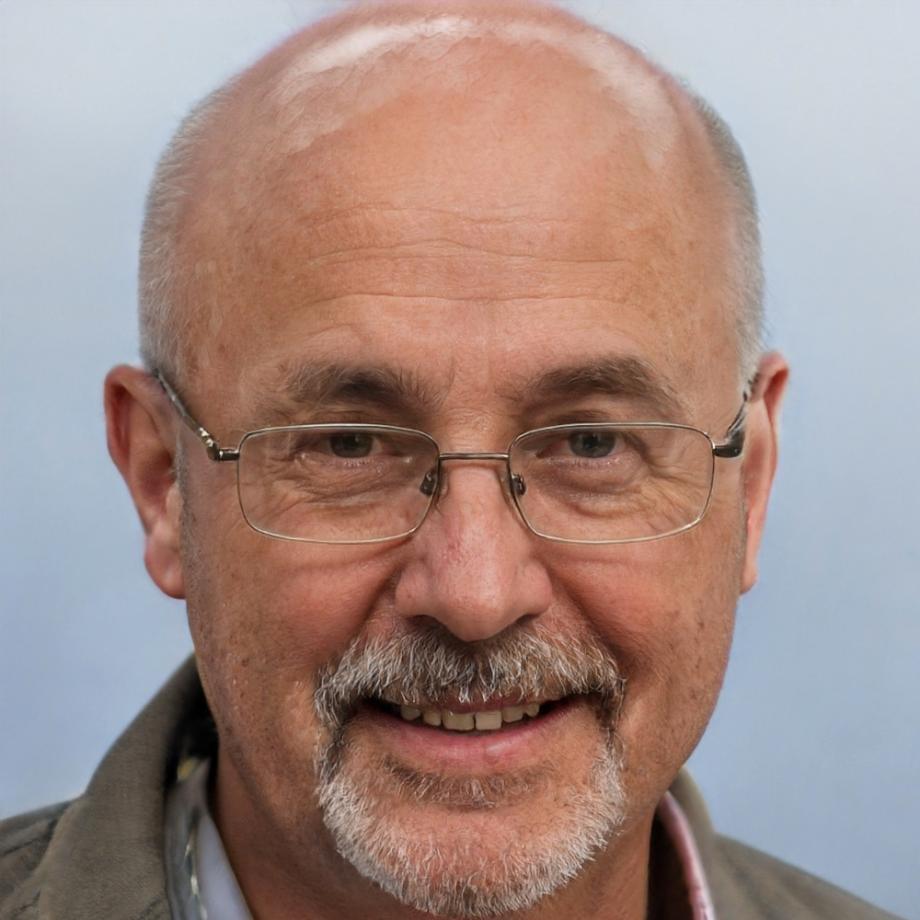

Gregor Lindstrom

Portfolio Strategy

Spent 15 years managing portfolios for Canadian families. Survived the 2008 crash, the pandemic drop, and countless smaller corrections. Now teaches the framework that kept clients from bailing at the worst times.

Ainsley Dahlberg

Risk Assessment

Former institutional risk analyst who specialized in stress testing portfolios. Helps students understand what can go wrong before it does. Known for making complex risk concepts actually make sense.

Oskar Bjornsen

Market Analysis

Tracked market trends for two decades across commodities, equities, and fixed income. Teaches students to separate market noise from actual signals. Emphasizes that most "news" doesn't matter as much as you think.